A Case for Small & Mid Caps – 2Q15

06/19/2015

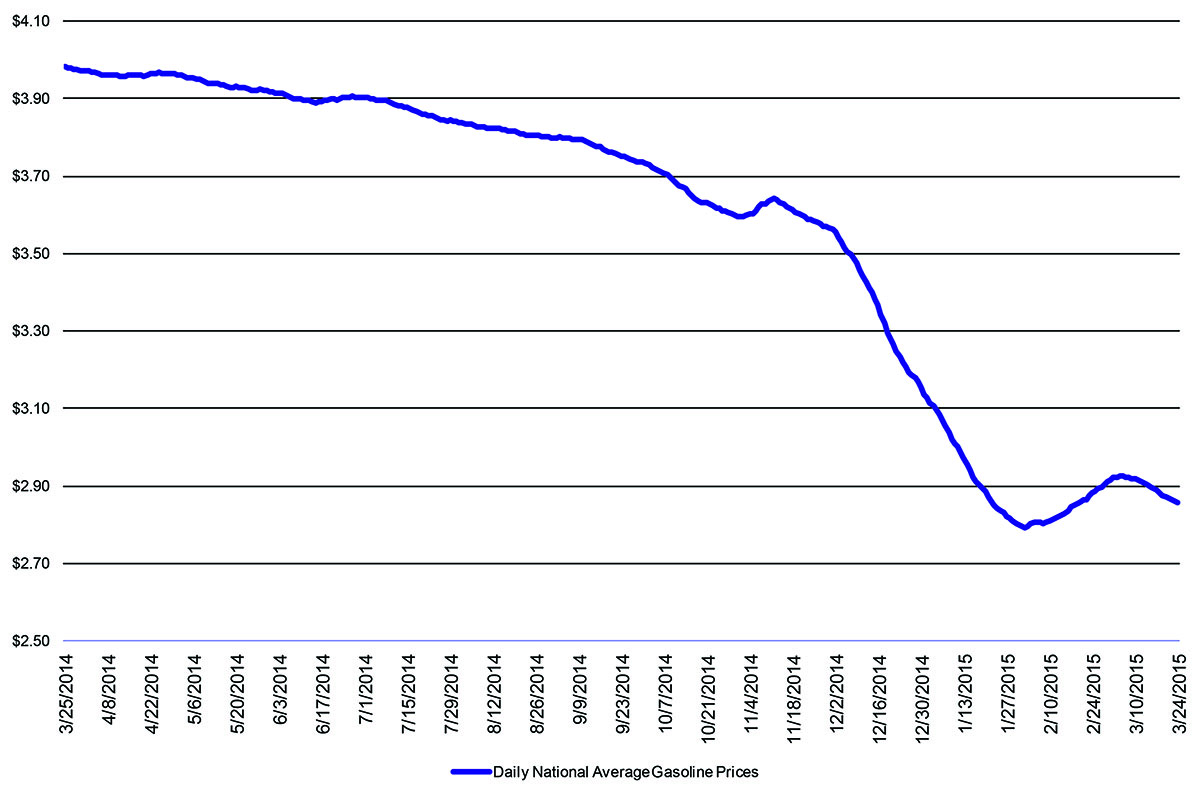

The U.S. consumer is poised to build strength into 2015 as the U.S. economy improves, labor market conditions solidify, and input costs remain historically low. Improved purchasing power for consumers is a result of the U.S. dollar improving on the prospects of a stronger economy and supply imbalances in commodities. Oil prices fell, which drove gasoline prices under $3 and greater discretionary income for U.S. consumers. These factors are largely a result of Federal Reserve action and economic growth, as market participants no longer find zero-interest rates critical to the success of the economy.

In this scenario, the entire equity spectrum is likely to benefit, but small and middle capitalization companies should benefit more than internationally-focused large capitalization stocks. U.S. small capitalization stocks derive 84 percent of sales from North America, making the asset class a favorable investment in the current market environment. Large capitalization companies derive only about 62 percent of sales from the North America, a less encouraging business model in a rising dollar environment that exposes the company to currency transaction exposure when a dollar precipitously increases.

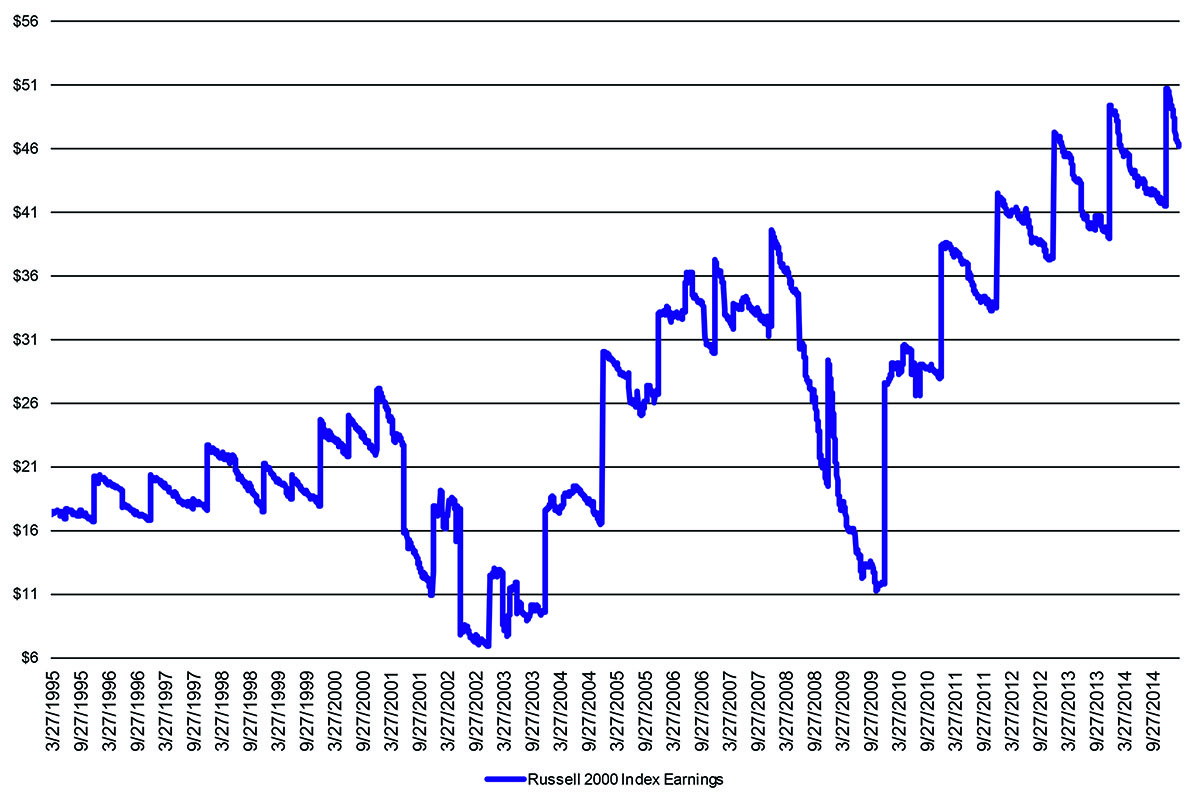

The fundamentals also reflect the growth potential of small and middle capitalization stocks with the market expecting earnings of $46 per share for the Russell 2000 index, a slight increase from last year. Market participants already realized this trend in the first quarter of 2015, as the Russell 2000 index returned 4.3 percent, which is greater than its large capitalization counterpart of about 1 percent. As long as the aforementioned trends remain intact and conducive for economic growth, those small and middle capitalization stocks exposed to U.S. domestic markets will likely benefit.

Dollar Strength

Source: Bloomberg

Gasoline Prices Remain at Low Levels

Source: Bloomberg

Fundamentals Remain Intact

Source: Bloomberg

For more information, please contact your Fifth Third Bank Client Consultant.

View All Articles >

Equal Housing Lender

Equal Housing Lender