Implications of Federal Reserve Policy – 2Q15

06/19/2015

The market reaction to an eventual increase in the Federal Funds Rate has wide implications going forward. Loose monetary policy from the Federal Reserve helped stimulate the economy at the beginning stages of the recovery, although it has lost significance as the economy returns to normalcy. Federal Open Market Committee (FOMC) members recognize this, but would rather wait for clarity before modifying monetary policy.

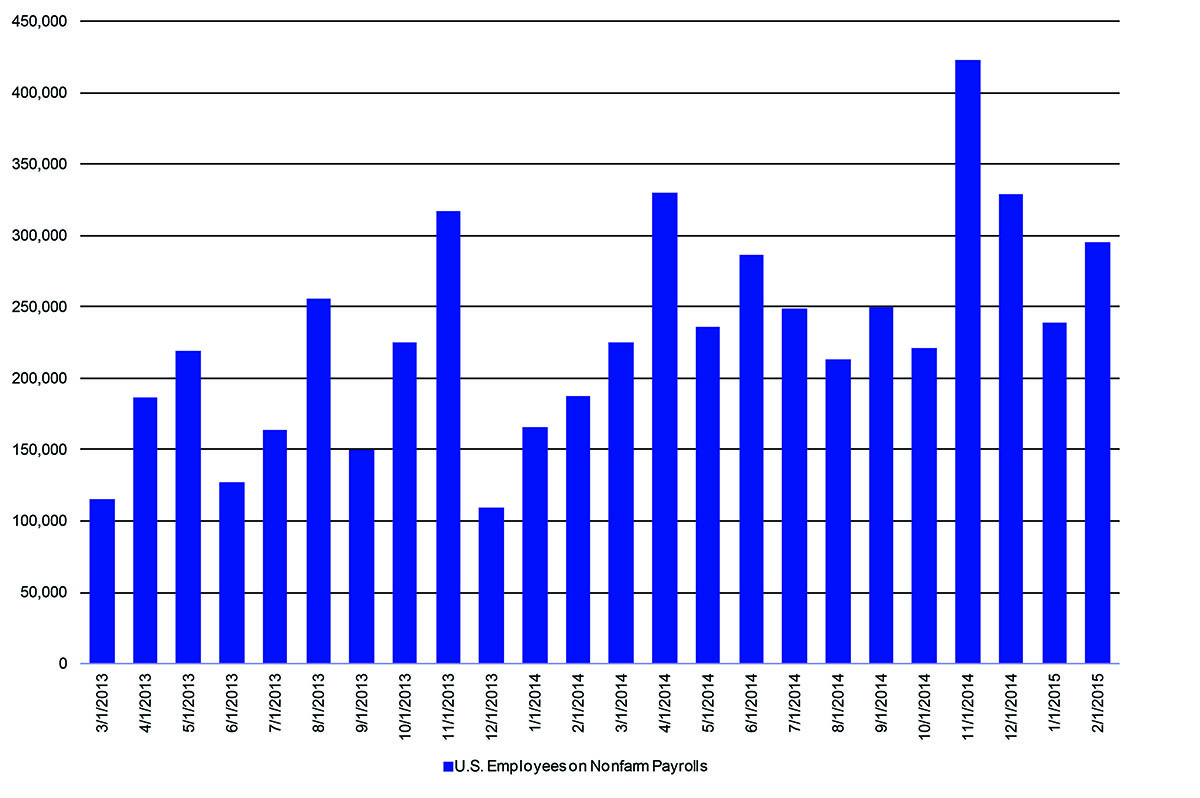

Growth in the first quarter provided FOMC members with less clarity and fewer reasons to quickly raise the Federal Funds Rate. Among the indicators that turned weaker include the addition of nonfarm payrolls, retail sales, and the manufacturing Purchasing Managers Index. After 200,000 jobs were added for 12 straight months, the streak broke after a weaker-than-expected reading in March. Retail sales did not recover as fast as many thought, amid a decline in oil prices. Finally, the manufacturing Purchasing Managers’ Index (PMI), a representation of manufacturing activity in the U.S., fell to a level of 51.5 in March – the lowest reading since 2013.

After the 10-year Treasury spiked higher to 2.20 percent at the beginning of March, it then drifted lower to a range around 1.90 percent. This is typically an indication of tepid growth prospects, as the four-year average of nominal gross domestic product is related to the 10-year Treasury yield. However, the economy has been affected by external factors, which is not indicative of U.S. economic prospects.

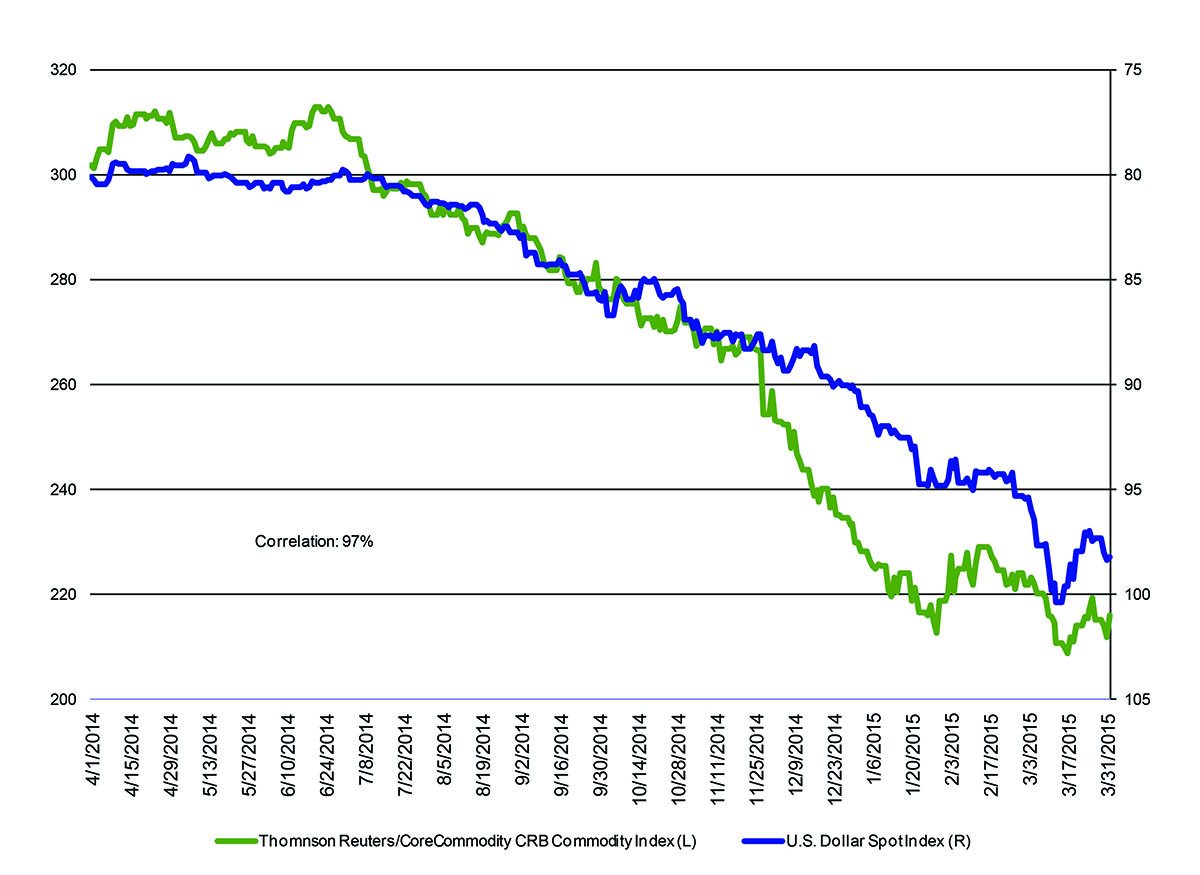

In response to potential action by the Federal Reserve this year and growth returning to its trend in 2014, the U.S. dollar began to rise precipitously higher. Investors sold currencies in which their respective central banks are looking to engage in accommodative monetary policy, while buying the U.S. dollar. Although, the precipitous increase in the dollar has weighed on the economy.

Companies with large exposure to international markets were most affected by the degree of increase in the dollar. Their revenues brought home from overseas sales declined, which weighed on earnings and sales growth for the first quarter reporting period. Domestic companies that engage in commodity and energy production were also indirectly hit by the rise in the dollar. Oil and commodities have been inversely related to the dollar over the past five years, causing the profits of companies that rely on natural resources to decline as they realize a lower price for each unit sold.

U.S. Dollar Index

Source: Bloomberg

U.S. Employees on Nonfarm Payrolls

Source: Bloomberg

Commodity Price Reaction

Source: Bloomberg

For more information, please contact your Fifth Third Bank Client Consultant.

View All Articles >

Equal Housing Lender

Equal Housing Lender