Fifth Third Private Bank Our Life360 Process

Fifth Third Private Bank’s Life360 Process helps simplify financial complexity for affluent clients through advanced technology and collaboration with our talented, dedicated, and passionate professionals.

Life360: Your Financial Road Map

To understand your life, your values, and your financial goals, a Fifth Third Wealth Management Advisor (WMA) will meet with you to get a 360-degree view of your financial life. Our Fifth Third Private Bank Life360SM Process is our unique, disciplined approach to help you achieve your goals.

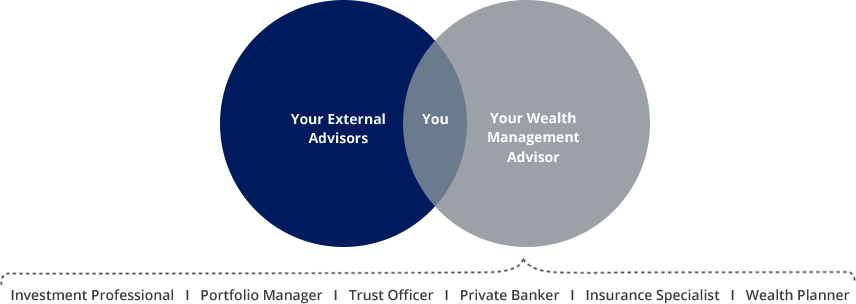

Collaborate To Build Your Team

As we understand your needs, your WMA builds your team from a deep pool of talented proven professionals, including Wealth Planners, Investment Professionals, Private Bankers, Risk Management and Insurance Specialists, and Trust Officers. Working together, they collaborate with you and your external advisors to formulate your financial plan. We have enabled that plan with technology including a personalized Life360 website to help you stay on track for your goals.

Challenge You To Achieve

Your life is busy and there can be many distractions keeping you from achieving your financial objectives. Your WMA challenges you to achieve your goals by helping you stay on track as your plan is developed and executed. Your WMA also coordinates your Fifth Third Private Bank team, as well as your external advisors, to ensure each individual fulfills his or her role and responsibilities in achieving your plan. Finally, we continue to monitor and review your plan, adjusting it periodically based on the changes that occur within the market, the economy, and your life.

The Life360 Platform

With our Life360 Technology platform, the answers are here, wherever you are.

Access all your accounts on one page, get updated on your investments, track your progress against your plan, store important documents and more.

Our Approach

Our personal financial planning process always starts with a conversation.

- What are your passions?

- What worries you?

- What are your values?

After all, this is an ongoing relationship. With Fifth Third Private Bank, you will work with a dedicated Wealth Management Advisor. You'll be able to leverage the knowledge and experience Fifth Third has amassed from serving high-net-worth clients for over 100 years.

To serve you best, we need to understand what’s important to you:

- Your life, family, and values

- Your aspirations

- Your current finances

- Your concerns and complexities

- Assess wealth and estate planning concerns, banking requirements, investments, complexities, insurance, trust, and estate needs

- Collaborate with you and your external advisors

- Develop your wealth management strategy

- Build your plan

- Implement your plan

- Monitor your plan

- Adjust your plan—based on changes in the market, the economy, and your life

Identify your needs

Your financial life can be simplified when you work with a team of talented professionals who can advise you on all aspects of your finances.

Navigating the financial options available to you—especially when you have significant assets—can be challenging. This is one reason why a Wealth Management Advisor can be so helpful.

What You Need

Your Wealth Management Advisor will begin a conversation with you to uncover your personal history, values, and financial challenges.

- How did you get where you are today?

- Where do you want to go next?

- Are there any financial concerns that keep you up at night, or opportunities you should seize?

Your wealth management team will be assembled based on your unique needs, so you get a plan that integrates all aspects of your financial life.

A successful wealth plan is based on your needs and your aspirations. That's why we take the time to get to know you.

Building Your Financial Plan

Fifth Third specialists will collaborate with you and your other advisors to develop a sophisticated financial plan that can evolve over time.

Your plan will integrate the many pieces of your financial life, reflect your current goals and values, and provide recommendations to help you reach those goals.

We'll work through our broad range of financial services to find the solution that's right for you and provide you the technology tools to store important information, facilitate collaboration across your advisors and allow you to get timely updates on your financial picture.

Legacy Wealth Management

Legacy wealth management is an ongoing process that requires creative solutions. So, we provide continual asset monitoring and meet with you regularly to review your plan, adjusting periodically based on changes in financial markets or in your life. Life events that may trigger the need for an adjustment include:

- Job change

- Marriage or divorce

- Loss of a loved one

- Need to care for elderly parents or special needs individuals

- The birth or adoption of a child

- Inheritance or major financial purchase

Your life and the markets may fluctuate, but your Fifth Third Private Bank team will remain focused on your goals.

Bank with Experience

Article

A guiding hand after you are gone. Pass your wealth and values on to loved ones with an incentive trust.

Video - Life360 - Looking Forward

Article

When to choose a corporate fiduciary. Sometimes a family member isn't the best choice to serve as executor of an estate.